Author: Craig Upton

Creating strategic partnerships and supporting data with extensive research in the latest trends Craig is well versed with most products within the financial sector.

If there’s one thing nearly every business owner moans about, it’s waiting to get paid. You deliver the work, you send the invoice, and then you’re stuck refreshing your bank account like a bad habit. Meanwhile, bills don’t wait, staff need paying, and opportunities pass because your cash is tied up in someone else’s bank […]

Read More

If you run a business in the UK right now, you’ve probably felt the financial whiplash of the past few years. Interest rate hikes, stubborn inflation, supply chain weirdness, political changes, and banks that suddenly prefer saying “no” rather than “let’s see what we can do” it’s been a ride. But here’s the interesting part: […]

Read More

Starting a business in the UK isn’t for the faint-hearted. You’ve got the vision, the hustle, and maybe even your first few paying customers. But when it comes to accessing capital? That’s often where things get complicated, fast. If you’ve been turned away by traditional lenders, you’re not alone. Banks tend to avoid startups like […]

Read More

A merchant cash advance (MCA) can feel like a lifeline when your business needs quick funding. It’s fast, flexible, and doesn’t involve the hurdles of a traditional bank loan. But because MCAs are short-term and often come with higher costs, using them wisely is crucial. If you treat an MCA as just a stopgap, it […]

Read More

When your business needs funding, finding the right finance solution is rarely straightforward. From navigating complex lender criteria to structuring a deal that actually gets approved, there is a lot at stake. That is where a commercial finance broker can make a significant difference, but only if you choose the right one. At Rosewood Finance, […]

Read More

When businesses need fast access to short-term funding, commercial bridging loan finance in the UK can be a powerful solution. Whether it’s to secure a property, cover a temporary cash flow gap, or complete a time-sensitive deal, a bridging loan offers flexibility and speed that traditional loans often lack. In this post, we’ll explain what […]

Read More

Access to funding can make or break a business, particularly in today’s fast-paced and competitive landscape. Encouragingly, SME lending in the UK rose by over 30% in the first quarter of 2025 compared to the same period last year. Whether you’re looking to expand, invest in equipment, or manage a short-term cashflow gap, commercial loans […]

Read More

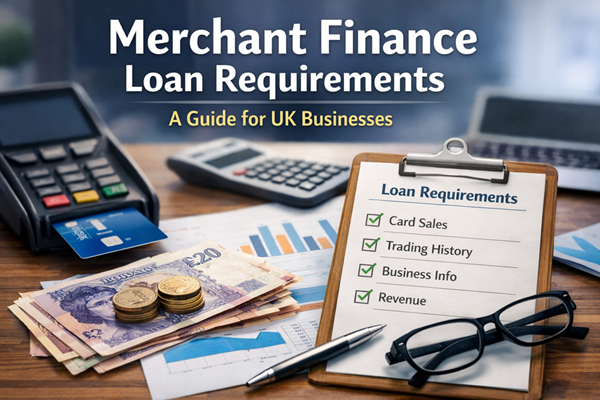

If you run a business and often face fluctuating income or time-sensitive opportunities, a merchant cash advance (MCA) might be the financial lifeline you didn’t know you needed. Unlike traditional loans, MCAs are designed with flexibility in mind, particularly useful for sectors with daily card transactions and seasonal cash flow dips. But while many businesses […]

Read More

When you’re running or growing a business, cash flow gaps and sudden expenses can be a headache. If you’re looking for quick access to finance without risking your assets, an unsecured business loan may be the answer. But one key question likely pops into your mind straight away: How much can I actually borrow with […]

Read More

In the fast-paced world of property transactions and financial planning, timing can be everything. Whether you’re a property investor, a homeowner, or a business owner, there are moments when you need immediate access to funds to seize an opportunity or avoid a financial setback. This is where a bridging loan can step in as a […]

Read More