Get started with your finance quote

- Borrow from £5,000 to £10m

- Quick Decision

- No Obligation

Whether you are planning to start a new business from scratch or looking to take an existing enterprise to the next level, an affordable commercial loan could make all the difference. At Rosewood Finance, we specialise in cost-effective commercial loans for all purposes, starting at just 6.0%.

From commercial property loans to commercial development loans to specialist start-up loans for new businesses, we can provide the affordable funding you need to put your plans into action.

Call anytime for more information on current commercial finance rates or to discuss any of our commercial loan options in more detail.

The term “commercial finance” refers to almost any facility where a sum of money is issued to a borrower exclusively for business purposes. Similar to mainstream loans, a commercial loan attaches an agreed rate of interest (typically communicated as an APR) along with additional borrowing costs (like arrangement fees and admin fees).

The key difference between conventional loans and commercial loans is that the latter are issued exclusively to businesses and must be used for business purposes. Typical applications for commercial loans include funds for launching a new product, equipment purchases, buying inventory, covering the costs of machinery repairs, funding building renovations, and so on.

Loan terms (repayment periods) are always negotiable (anything from one month to a decade or longer), and sums start at around £1,000 with no specific upper limit.

A business loan calculator will help you determine your affordability and how much money you may borrow. The maximum loan amount you qualify for is determined by a variety of factors.

You may anticipate that your company’s present size and worth will be evaluated, as well as its credit history, professional background, financial track record, and immediate and long-term financial future.

Working out which type of commercial loan is right for you begins with carefully considering your objectives, your requirements, and your budget. This is where the input of an experienced commercial finance broker can prove invaluable, providing access to the objective insights you need to make the right choice for your business.

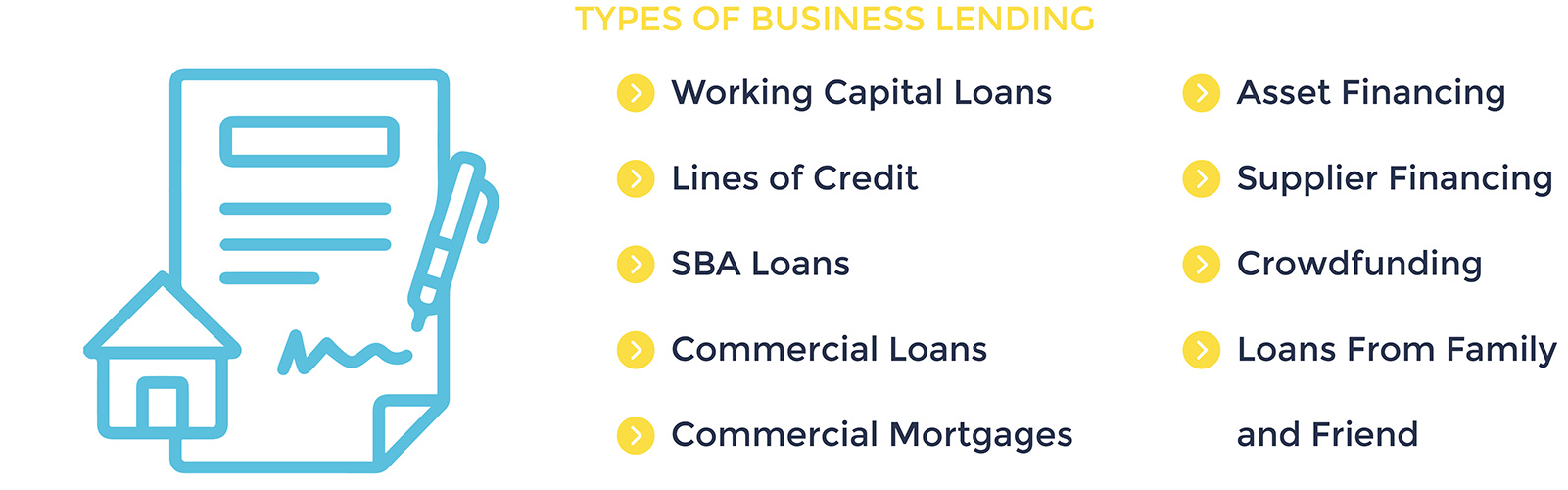

All goods and commercial loans are tailored from scratch to meet the unique requirements of the applicant and their business. Or even so, there are four broad categories of business loans, within which most commercial facilities fall:

As each of these solutions has its own advantages and disadvantages, it’s a good idea to learn how they function before you determine which choice is best for you.

The short answer is yes, but with a few inevitable caveats. In the commercial arena, specialist lenders do not always base their decisions exclusively (or even predominantly) on credit scores. This is particularly true with secured business loans, wherein the borrower is required to provide assets of value as security for the loan.

With secured business loans, an applicant’s credit history is often a side issue. With viable security to cover the costs of the loan and evidence of your ability to repay your debt as agreed, you have a higher chance of qualifying, irrespective of your credit score.

Even so, it is of the utmost importance to ensure you target the right lenders with your applications if you are seeking “subprime” products for poor-credit applicants. Your broker will help assess the strength of your case in advance while providing the support you need to submit a convincing application to an appropriate lender.

Here’s what you can (and should) do to ensure you get a competitive deal on any commercial product:

If you would like to learn more about commercial loans or have any questions regarding your eligibility, the Rosewood Finance team is standing by to take your call. You can also use our exclusive online commercial loan calculator to get a better idea of how the facility works.

Funding for small business establishments can be approached in a variety of ways. From secured business loans to specialist small business funding products backed by the UK government, there is no shortage of options to explore.

At Rosewood Finance Ltd., we specialise in affordable funding for small businesses to suit all requirements and budgets. Whether you are looking to start your first business or seeking a small business loan to expand your commercial portfolio, our new business funding solutions cover all requirements.

Business loans for UK entrepreneurs and start-ups are available via multiple channels. Unfortunately, the fact that most types of secured loans are issued as secured loans means they are often restricted to established businesses with on-hand assets of value.

To address this issue, the British Business Bank and the Start-Up Loan Company recently established a new relationship.

The qualification criteria for these unsecured new business loans state that the applicant must:

The key difference between these government-backed loans and typical business loans is that they are unsecured. You do not need to have substantial assets to qualify, but you, not your firm, are responsible for ensuring the loan is returned.

In addition to affordable funding, recipients of these special small business loans also receive one year of free professional mentoring. The repayment durations are adjustable (anywhere between one and five years), and the APR is fixed at 6% for the life of the arrangement. Businesses who want to lower their total borrowing expenses can return the full balance of their loan in advance, with no penalty penalties or levies.

For more information on how business start-up loans work or to discuss your eligibility, reach out to the team at Rosewood Finance anytime.

Business loans are designed to provide small and large organisations alike with both the capital and the flexibility they need to support their performance and profitability.

A competitive business loan from a reputable provider can bring the following benefits, among others:

Small business loans can be great for providing any smaller enterprise with a welcome cash injection. They also bring near-complete freedom of choice where potential applications are concerned, as lenders impose comparatively few restrictions on how small business loans can be used.

Typical applications for business loans among UK SMEs include purchasing equipment or machinery, buying stock and inventory, paying for office space or leasing premises, repairing and maintaining machinery, temporarily covering staffing costs, and so on.

A small business loan, aka small business finance, is a lending facility provided exclusively for small businesses. Small business finance companies create bespoke solutions for the SMEs they support, with flexible terms and conditions to suit all requirements.

Specialist small business loans can be used for a wide variety of purposes, with comparatively few limitations. Small business start-up loans, cash flow loans for small businesses, commercial credit facilities, and overdrafts are just a few of the many options available.

Most small business loans from UK providers are gradually repaid over the course of several years. However, there are some facilities (like bridging finance) that are designed to be repaid as promptly as possible in the form of a single lump-sum payment.

Small business loans are suitable for new and established entrepreneurs, like anyone looking to cover the costs of a new business establishment through third-party funding. However, affordability should always be your top priority when applying for business finance.

Small business funding can be sourced in a variety of ways, in accordance with the requirements of the applicant. All small business contracts are drawn up as bespoke agreements, with affordable options available to suit all budgets.

Just a few of the various types of small business loans available include the following:

Ensuring you get an unbeatable deal starts with choosing the ideal product to suit your business and its requirements. At Rosewood Finance, we can provide you with the objective and impartial advice you need to make the right choice for your business.

The term “working capital” refers to the on-hand cash resources a business has at any one time to conduct its affairs. Consequently, working capital finance is a product issued to boost the amount of cash a business has access to.

Working-capital loans free up cash and provide businesses with greater flexibility. Small business working capital loans in particular can be useful for giving SMEs the spending power needed to grow their businesses.

A working capital loan can take many forms. The term is more of a category than a product in its own right. Working capital loans from UK providers can be issued as anything from overdrafts to merchant cash advances to revolving credit facilities.

At Rosewood Finance, we can help you find the perfect working capital business loan to support your company’s cash flow. For more information or to discuss the options available in more detail, contact a member of the team at Rosewood Finance today.

Prior to filing an application for a working capital loan, it is critical that you understand the many loan kinds available, such as:

Along with being issued for entirely different purposes, each of these commercial products has its own distinct advantages and disadvantages to consider.

Working capital loans, for example, are granted as a one-time arrangement, whereas revolving credit facilities are more continuing.

Contact our staff today to learn more and we will respond as soon as possible.

What are the repayment schedules?

Depending on the sort of business, some loans are returned in a couple of months, while others require longer repayment periods.

Is paperwork required to apply?

A copy of your company plan, as well as recent tax returns and financial documents, will be required.

How long does approval take?

The amount of time you must wait for approval is based on the business that you carry out. Some business loans are authorised in a couple of days, while others take several months.

Are there any risks?

If you do not make the agreed-upon payments, you may lose your property.

How do I select the best sort of company loan?

Hire an independent broker to assist you in understanding your options and negotiating on your behalf to guarantee you receive the very best deal.