Get started with your finance quote

- Borrow from £5,000 to £10m

- Quick Decision

- No Obligation

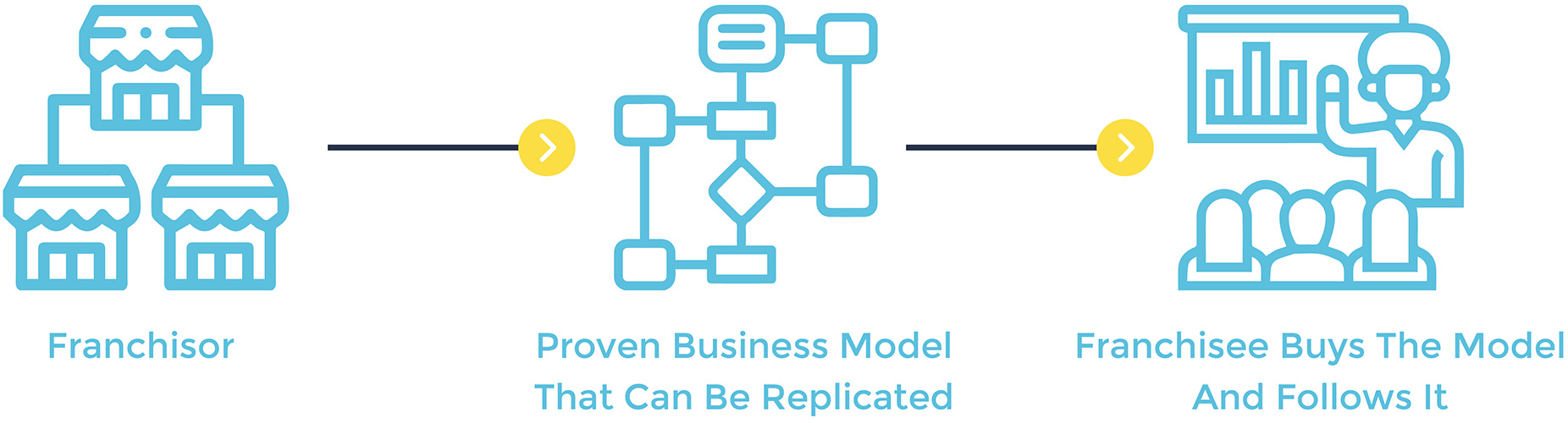

Franchising can be a great way of launching and running a successful business, complete with the support of the franchise service provider. But as the initial costs of setting up a franchise can be comparatively high, many entrepreneurs seek external funding to get their businesses off the ground.

Franchise loans are bespoke financial products issued specifically to finance franchise opportunities. There is a broad range of franchise finance options available for UK entrepreneurs, including franchise invoice finance, franchise credit facilities, franchise business loans and more.

In all instances, franchise finance is issued to help entrepreneurs cope with the costs of setting up and running a franchise. A franchise loan can be taken out to fund the initial establishment of the franchise, while franchise invoice financing can be useful for covering temporary financial shortfalls.

Setup costs vary significantly from one franchise type and brand to the next. Some businesses that offer franchise opportunities subsidise certain costs, while others expect their franchisees to cover all setup and running costs themselves.

Consequently, it is difficult to pin the costs of setting up a franchise to even a rough average. Starting your own franchise business can cost as little as £5,000, or you could easily spend more than £500,000 in setting up a different kind of franchise.

For prospective entrepreneurs, figuring out how to finance a franchise start up can be the most complex task of all. In the vast majority of instances, franchise purchases are funded by specialist franchise loans from UK providers, coupled with personal funding from the franchisee.

While it is technically possible to arrange funding for close to 100% of the initial franchise set-up costs, loans for franchise purchases are typically limited to around 70% to 80% of the total initial investment.

Before you set out on your franchise journey, it may pay off to create a business plan. Creating a franchise business plan involves several key steps, including:

The below graphic explains what you should keep in mind before deciding on your franchise of choice:

Creating a franchise business plan is a critical step in the process of starting and growing a successful franchise business. It requires careful research, planning, and attention to detail, and should be reviewed and updated regularly as the business grows and evolves.

Eligibility for business loans for franchise investments is assessed on the basis of several factors. Examples of which include the applicant’s experience and track record, their financial status at the time of application, their credit score, the viability of their business plan and the current performance of the sector in question.

A business loan for franchise funding will always be issued in the form of a secured loan. This means that the total combined value of the applicant’s assets (usually their home or business property) will determine the maximum loan amount they can access.

Loans for franchise businesses are typically issued at a maximum LTV (loan to value) of 70% to 80%. However, it may be possible to cover 100% of all initial franchise setup costs, by providing security that comfortably exceeds the total value of the loan.

Getting a Loan to Buy a Franchise – Essential Tips and Guidelines

If you would like to boost your chances of qualifying for a competitive deal from a top-rated franchise loan company, the following tips and guidelines could help:

Once you have obtained franchise funding, there are several ways you can spend the money to grow and improve your business. Here are some thing franchise finance would be typically used for:

Franchise funding can be used to cover a wide range of expenses related to starting, operating, and growing a franchise business. It is important to carefully plan and budget the use of the funds to ensure that

There are several reasons that could cause a franchise finance loan application to be rejected, including:

It is important for franchise finance loan applicants to carefully review the lender’s requirements and ensure that they meet all of the necessary criteria before submitting an application. They should also be prepared to provide detailed financial projections and documentation to support their application, and be willing to work with the lender to address any concerns or questions they may have.

Making a franchise a success requires a combination of factors, including careful planning, hard work, and a commitment to following the franchise system. One of the most important steps in building a successful franchise business is choosing the right franchise. You should select a franchise that aligns with your interests, experience, and skills, and has a proven track record of success. By choosing the right franchise, you can increase your chances of success and reduce your risk of failure.

Once you have chosen the right franchise, it is important to follow the franchise system. Franchise systems are designed to help franchisees succeed by providing them with a roadmap for success. You should follow the franchise system, including operating procedures, marketing strategies, and training programs, to maximise your chances of success. By following the advice provided, you can avoid common pitfalls and ensure that you are taking the right steps to build a successful franchise business.

Building a strong team is also critical to the success of a franchise. You should hire employees who share your vision and values, and provide them with training and support to help them succeed. By building a strong team, you can create a positive work environment and provide exceptional customer service, which is essential to acheiving a loyal customer base.

Providing exceptional customer service is another key factor in building a successful franchise business. You should strive to exceed customer expectations by providing personalised service, resolving issues quickly, and maintaining a positive attitude. By providing exceptional customer service, you can build a loyal customer base and differentiate your franchise from competitors.

Implementing effective marketing strategies is also essential to driving customer traffic and building brand awareness. You should use a combination of online and offline marketing channels, such as social media, email marketing, and local advertising, to reach your target audience. By implementing effective marketing strategies, you can increase your visibility and attract new customers to your franchise business.

In addition, it is important to monitor your financial performance to ensure that you are on track to meet your goals. You should track key performance indicators, such as revenue, expenses, and profit margins, to ensure that you are making progress towards your business objectives. By monitoring your financial performance, you can identify areas for improvement and make adjustments to your strategy as needed.

Making a franchise a success requires hard work, dedication, and a commitment to following the franchise system and providing exceptional customer service. By focusing on these key factors, you can increase your chances of building a successful franchise business.

At Rosewood Finance, we offer a broad range of flexible and affordable franchise loans and funding solutions for UK entrepreneurs. For an overview of the options available please call anytime for an obligation-free consultation.

With Rosewood Finance, you can borrow anything from £1,000 to £500,000, with flexible repayment terms up to 24 months. We aim to provide all applicants with a decision within one working day, and there is always the option to repay early with no fees or penalties.

Call today to learn more, or email Rosewood Finance with details of your requirements and we will get back to you as soon as possible.

With a franchise loan, you have the opportunity to get your franchise business off to a successful start – without having to put significant sums of your own money on the line. The full balance of the loan can be repaid over a series of affordable monthly repayments, enabling you to maximise your on-hand capital and continue investing in your business.

However, there are alternative options to conventional franchise loans available, which may be more suitable for some entrepreneurs. Examples of which include the following:

If you would like to learn more about the different funding options available for franchise businesses, contact a member of the team at Rosewood Finance today for an obligation-free consultation.

Similar to invoice finance, supply chain financing provides businesses with the opportunity to access cash-based monies owed to them. In business, it is the norm for invoices to be issued with fairly flexible repayment terms. With B2B transactions, the debtor may have anything from 10 to 90 days to settle their debts.

In the meantime, a supply chain finance provider can cover this temporary ‘gap’ with an affordable loan. Supply chain finance solutions exist to help businesses maintain optimum cash flow, irrespective of how late their own customers settle their debts.

Here is a brief overview of how supply chain finance works in practice:

With supply chain finance, UK companies can control and stabilise their cash flow at short notice, enabling them to ‘bridge’ temporary financial gaps.

Supply chain finance is essentially a more advanced form of invoice financing, aimed primarily at larger businesses and high-turnover suppliers.

Where effective, supply chain financing can be mutually beneficial for both suppliers and buyers alike.

Just a few of the benefits of supply chain financing services include the following:

If you would like to learn more about the potential benefits of supply chain finance, contact a member of the team at Rosewood Finance anytime.

At Rosewood Finance, we specialise in cost-effective supply chain financing solutions for UK SMEs. Whether you are looking to bridge an unexpected financial gap or in need of support with an ongoing invoice factoring solution, we can help.

Rosewood Finance will help you choose the right product to support your business, and we will do our best to provide you with a prompt decision. All with no obligation to go ahead at any time, coupled with the objective and impartial advice of our experienced team.

Call today for an obligation-free consultation, or email us with details of your requirements and we will get back to you as soon as possible.

What types of businesses can be financed through franchise finance?

Franchise finance can be used to finance a variety of franchise businesses, including food and beverage outlets, retail stores, and service-based franchises.

What factors are considered when determining the interest rate for franchise finance?

The interest rate for franchise finance depends on a variety of factors, including the creditworthiness of the borrower, the type of franchise being financed, and the length of the loan term.

What happens if the franchise business fails?

If the franchise business fails, the borrower may be responsible for repaying the loan, even if the business is no longer generating revenue. It is important for borrowers to carefully assess the risks associated with starting or expanding a franchise business before applying for financing.

Can franchise finance be used to open multiple franchise locations?

Yes, franchise finance can be used to open multiple franchise locations. However, lenders will typically require additional collateral and may have stricter requirements for borrowers seeking financing for multiple locations.