Running a Startup? Here’s Why Merchant Cash Advances Are Worth Considering

Starting a business in the UK isn’t for the faint-hearted. You’ve got the vision, the hustle, and maybe even your first few paying customers. But when it comes to accessing capital? That’s often where things get complicated, fast.

If you’ve been turned away by traditional lenders, you’re not alone. Banks tend to avoid startups like the plague. But that doesn’t mean you’re out of options. In fact, there’s a funding solution designed to move at the speed your startup needs: Merchant Cash Advances (MCAs).

What is a merchant cash advance?

Let’s clear the air. A merchant cash advance isn’t a loan in the traditional sense. Instead, it’s a lump sum of capital provided upfront, which you repay through a percentage of your daily card sales.

It’s flexible, fast, and doesn’t require years of trading history or stellar credit.

Why startups shouldn’t dismiss merchant cash advances

While merchant cash advances are often associated with more established businesses, they can actually be a smart funding option for early-stage startups too. If your business takes card payments and needs quick access to capital, an MCA could offer the flexibility and speed traditional finance simply can’t match.

1. Speed is everything in the startup world

Banks might take weeks, if not months, to say “no.” With a merchant cash advance, you could access funding in 24 to 48 hours. That means you can move on an opportunity today, not six weeks from now.

Whether it’s a time-sensitive supplier discount, a marketing push, or onboarding your first team members, speed can be the difference between growing and stalling.

2. No trading history? No problem

Let’s be honest: most early-stage businesses don’t have two years of financial statements to impress a bank manager. But MCAs don’t judge you by that standard.

If you’re generating consistent card payments, even at modest levels, you could qualify. That’s a massive plus if you’re in year one and already proving product-market fit.

3. Repayments that flex with your revenue

Startups are rarely predictable. One month you’re smashing it, the next you’re holding your breath. MCA repayments adapt to this reality by taking a percentage of daily card revenue, not fixed monthly instalments.

So during quieter periods, you repay less. No pressure. No penalties.

4. No collateral required

Unlike traditional business loans, merchant cash advances are unsecured. That means you’re not putting your house, car, or equipment on the line.

That’s a big win for first-time founders who don’t want to risk everything to scale.

5. Short-term capital, long-term growth

MCAs aren’t meant to be long-term debt solutions, but that’s exactly why they can work so well for startups. You use the funds to generate growth now, then repay quickly as your revenue grows.

Here’s what startups are using MCAs for:

- Launching paid ad campaigns with immediate ROI

- Restocking fast-selling inventory

- Hiring freelancers or contractors during busy periods

- Moving into a small retail space or office

If you know how to turn capital into growth, a merchant cash advance can be a powerful tool in your startup playbook.

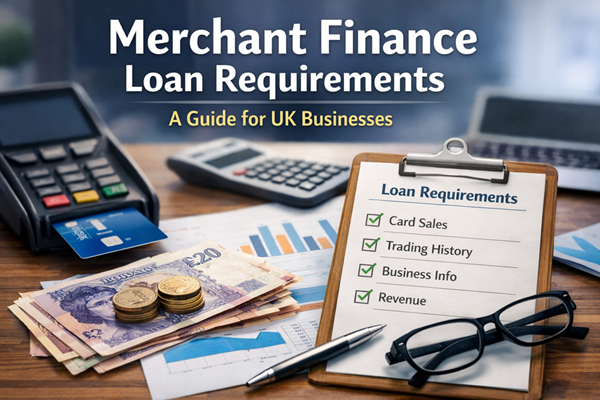

The honest bit: Costs are higher – but so is the upside

Let’s not sugar-coat it: MCAs aren’t the cheapest form of funding. The cost of capital is higher than a bank loan. But the trade-off is accessibility and speed, two things traditional finance simply doesn’t offer startups.

The real question isn’t “Is it cheap?”

It’s, “Can I generate a return that justifies the cost?”

If the answer is yes, then the value of speed and flexibility far outweighs the higher price tag.

Final word: Is a merchant cash advance right for your startup?

If you’re an ambitious founder with solid card sales and big plans, a merchant cash advance could be the fuel that takes your startup to the next level, without the slow dance with traditional lenders.

At Rosewood Finance, we work with early-stage businesses across the UK to provide fast, fair, and flexible capital. No jargon. No time-wasting. Just funding that works for you.

Ready to move fast?

Apply in minutes, get a decision in hours, and if approved, funds could be in your account in 24 – 48 hours.